How To Get $500 For Emergency Cash To Pay For Auto Repair.

Unexpected Car Repair: How to Pay if You Don't Take Emergency Funding

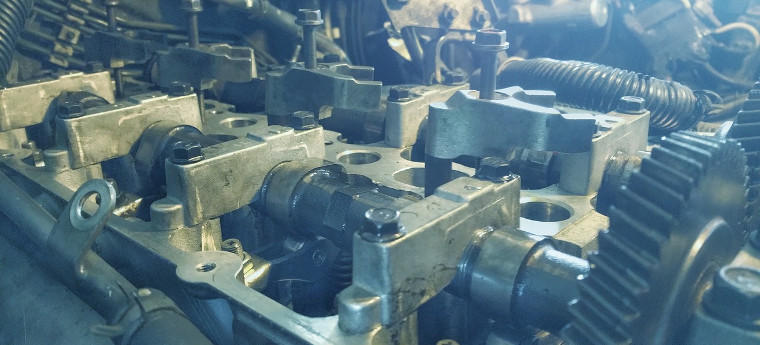

Your auto breaks down just when you need information technology the most. Cheque out how to get the coin to pay for the toll of your car repair if y'all have no emergency fund.

Asking a Loan Today*

*Past filling out the form above, you volition be routed to OpenLoans.com's loan request form.

What's the worst that could happen? Well, in this game we call life, the answer to that is "there's always something." One of those unexpected and unfortunate events is your machine breaking down. Just when you need it the well-nigh and right at the time when you don't have coin to spare to pay for its repair. According to AAA, the average cost of a car repair ranges from $500 to $600. Maintaining a new vehicle costs around $1,186 a yr simply to keep it running. Based on all that, how much practice yous call back it would price to become your former clunker road worthy again? Possibly more than yous can beget. Of grade, everyone says "build an emergency fund, that way you won't become caught unawares with your pockets going on empty." But it's not always so easy for some of us to put away hundreds of dollars. And so, what do you practice when you're in that particular hole? Well, not to worry. In that location are some options that may be open up to you.

Cheque if You Have Coverage

It'southward a practiced bet that you lot take some class of coverage that will pay for some of the expenses on that repair bill. If your car is new (at most iii years old or less than 36,000 miles), then the carmaker'south warranty may comprehend some of the repair costs. Older cars may exist covered by the extended warranty, that is, if you opted for extended coverage. If the repair yous require was caused by an accident, your automobile insurance should provide emergency roadside aid besides as pay for some of the repair expenses as long as you lot pay for your deductible start.

Even if you weren't in an blow, check with your insurance provider to meet if they provide complimentary emergency roadside assist. Some companies and organizations such equally AAA and AARP provide free roadside assistance to their members. Even some credit carte companies offer the same. While roadside assist isn't going to become your car up and running again, it'll aid ease some of the expense, and you won't take to worry well-nigh leaving your car where it broke down.

Shop Around for a Good Deal

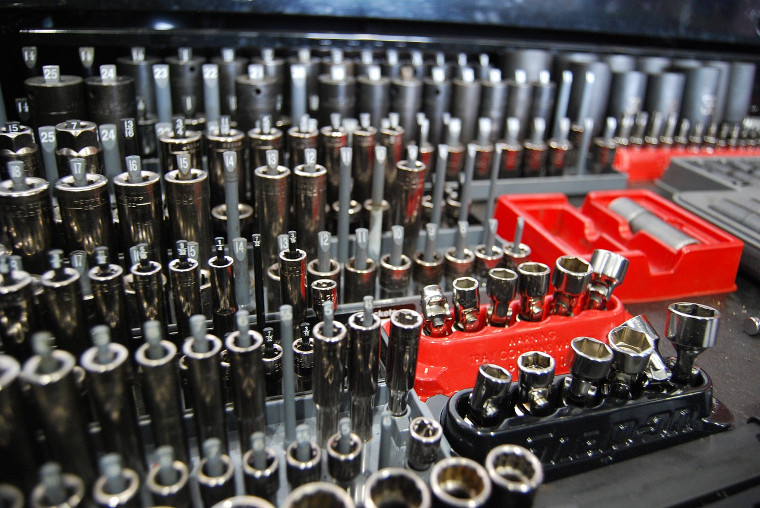

Before yous attempt to figure out where you need to become the money, you need to notice out how much you'll need to pay. Ask for estimates from at to the lowest degree 3 reputable repair shops. Allow them know that you're shopping around and would like to know how their offer compares to others. Enquire about any discounts that they accept bachelor. Some repair shops too offer payment plans which can be less heavy on your wallet than a lump sum payment. If you're a member of AAA, in that location are AAA approved repair shops that you lot tin go in impact with. These shops may offering discounts on labor to members, equally well as a 24-month or 24,000-mile guarantee on parts and labor.

If the estimates provided are still not within your budget, you lot can check with technical or vocational schools where you live. Find out if they teach classes on automotive mechanics. If they do, maybe they can employ your auto in 1 of their classes. You lot may be able to work out a bargain where they get a car to piece of work on, and you'll be responsible for paying for the parts needed.

Barter with a Friend

If yous can't get a practiced deal with a car repair store or professional person mechanic, peradventure you lot know someone who's pretty handy with cars – a neighbour, family fellow member, or friend who has the fourth dimension and skill to gear up your car in exchange for something of value such equally something you lot own or a skill or service that you can provide him.

Where to Become the Money

Once you get a good offer from a reputable repair store, you're going to need to go the money to pay for the cost of repair. And there are several options to choose from.

#1: Sell Personal Items for Quick Cash

If y'all have stuff that y'all don't demand, employ, or want, you can sell them on Craigslist, eBay, or at a garage sale for some quick cash. While y'all may non exist able to raise as much cash as you'll need to pay the repair bill, every unmarried dollar counts.

#2: Borrow from Friends and Family unit

If you're going to borrow money, it might exist best to get a loan that's interest-free. And you can only do that with friends and family. Now, this is a very catchy situation to be in considering non-payment tin can and probably will injure your relationship. To ensure that you avoid this, create a realistic payment programme that is doable, fair, and amenable to your generous family member or friend.

#iii: Consider Using Your Credit Card

This is an ideal option if you accept a credit menu that provides a warranty on bogus or bad repairs. It's even ameliorate if they offer a low-involvement rate. At present, the key matter here is to know whether or non the credit menu company offers this kind of protection and quite a lot of them do. As well, you'll demand to find out simply how much protection they offer and what the proper procedure is if y'all demand to claim that warranty.

For those with actually good credit (670+), here'due south an even better option - employ for a zero percent introductory April credit bill of fare and utilise that to pay for your repair bill. Of course, you'll need to make certain that you will be able to pay off the balance before that introductory interest charge per unit ends (typically six months to a yr and a one-half). This is considering the APR tends to become up later on that, averaging betwixt xv.49 percentage to 24.24 percentage APR.

Whether you lot get a new credit card with a zero percent Apr or utilize your old one, y'all need to make sure that y'all tin can keep up with the payments so that you don't finish up paying a lot due to interest charges. Make a payment plan and stick with it.

Also, don't use the cash advance characteristic of your credit carte du jour if you can avoid it. This is because greenbacks advances usually have a loftier-interest rate which starts charging you interest on the 24-hour interval you made the transaction. When the card is swiped, interest charges ordinarily kick in subsequently 21 days from the date of the purchase.

#iv: Become a Personal Loan

A personal loan is a type of installment loan that is unsecured. What this means is that yous don't put up whatever collateral in substitution for getting the loan. Now, compared to credit cards, personal loans take a much lower interest charge per unit for a fixed amount of time. The loan amounts typically range between $i,000 to $five,000 and the terms tin exist between two to five years. Of course, the loan amount, interest rate, and terms of car repair personal loan will all depend on your credit score. But the great affair almost this blazon of loan is that you lot tin can hands fit the monthly payment into your budget since you're getting a fixed charge per unit. Plus, at that place are a lot of lenders in this market such as credit unions, banks, and online lenders. This allows you lot to store for the best rate available. And while having skilful credit volition get you lower interest rates, fifty-fifty those with a bad credit score may find that there are lenders who are willing to give them a off-white April.

#five: Become a Automobile Title Loan

A motorcar championship loan is a type of secured loan where y'all become a loan using your car every bit collateral. The loan amount volition typically exist a quarter to half of your car's value. Keep in listen that this is not a recommended pace unless all the other options listed are not open to you. This is because a lot of lenders that offer this type of loan offering exceedingly loftier APRs. That's non all. If you fail to pay the loan off in time, the lender volition whorl the loan over which means that you lot'll terminate upwards with more fees and more than involvement.

Here are two things you need to practice to ensure you lot don't get in over your caput with a car title loan:

- Go along the term of the loan betwixt nine to 12 months. This gives you enough time to repay the loan in full without defaulting – simply non also much time that yous terminate up paying a total amount equal to the downward payment for a new car.

- Make sure that you afford the monthly payment which should use equally to the main of the loan and the involvement.

- Look for a reasonable April. While the national boilerplate APR given past these lenders is high, in that location are nonetheless some that offer much lower rates.

How To Get $500 For Emergency Cash To Pay For Auto Repair.,

Source: https://openloans.com/blog/unexpected-car-repair-how-to-pay-if-you-dont-have-emergency-funding

Posted by: longoherrinfold.blogspot.com

0 Response to "How To Get $500 For Emergency Cash To Pay For Auto Repair."

Post a Comment